In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services.[1] In modern economies, the most commonly used medium of exchange is currency.

The origin of "mediums of exchange" in human societies is assumed to have arisen in antiquity as awareness grew of the limitations of barter. The form of the "medium of exchange" follows that of a token, which has been further refined as money. A "medium of exchange" is considered one of the functions of money.[2][3][4] The exchange acts as an intermediary instrument as the use can be to acquire any good or service and avoids the limitations of barter; where what one wants has to be matched with what the other has to offer.[5][6]

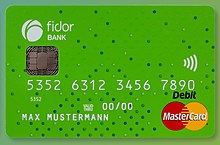

Most forms of money are categorised as mediums of exchange, including commodity money, representative money, cryptocurrency, and most commonly fiat money. Representative and fiat money most widely exist in digital form as well as physical tokens, for example coins and notes.

https://en.wikipedia.org/wiki/Medium_of_exchange

In economics, unit of account is one of the money functions. A unit of account[1] is a standard numerical monetary unit of measurement of the market value of goods, services, and other transactions. Also known as a "measure" or "standard" of relative worth and deferred payment, a unit of account is a necessary prerequisite for the formulation of commercial agreements that involve debt.

Money acts as a standard measure and a common denomination of trade. It is thus a basis for quoting and bargaining of prices. It is necessary for developing efficient accounting systems.

https://en.wikipedia.org/wiki/Unit_of_account

Equivalisation is a technique in economics in which members of a household receive different weightings.[1] Total household income is then divided by the sum of the weightings to yield a representative income. Equivalisation scales are used to adjust household income, taking into account household size and composition, mainly for comparative purposes. See also equivalizing.

https://en.wikipedia.org/wiki/Equivalisation

Fiat money is a type of currency that is not backed by a commodity, such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was quite rare until the 20th century, but there were some situations where banks or governments stopped honoring redeemability of demand notes or credit notes, usually temporarily. In modern times, fiat money is generally authorized by government regulation.

https://en.wikipedia.org/wiki/Fiat_money

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt.[1] Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt.

https://en.wikipedia.org/wiki/Legal_tender

In economics, standard of deferred payment is a function of money. It is the function of being a widely accepted way to value a debt, thereby allowing goods and services to be acquired now and paid for in the future.[1]

The 19th-century economist William Stanley Jevons, influential in the study of money, considered it to be one of four fundamental functions of money, the other three being medium of exchange, store of value, and unit of account. However, most modern textbooks now list only the other three functions, considering standard of deferred payment to be subsumed by the others.

Most forms of money can act as standards of deferred payment including commodity money, representative money and most commonly fiat money. Representative and fiat money often exist in digital form as well as physical tokens such as coins and notes.

https://en.wikipedia.org/wiki/Standard_of_deferred_payment

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves (intrinsic value) as well as their value in buying goods.[1] This is in contrast to representative money, which has no intrinsic value but represents something of value such as gold or silver, in which it can be exchanged, and fiat money, which derives its value from having been established as money by government regulation.

Examples of commodities that have been used as media of exchange include gold, silver, copper, salt, peppercorns, tea, decorated belts, shells, alcohol, cigarettes, silk, candy, nails, cocoa beans, cowries and barley. Several types of commodity money were sometimes used together, with fixed relative values, in various commodity valuation or price system economies.

https://en.wikipedia.org/wiki/Commodity_money

Commodities often come into being in situations where other forms of money are not available or not trusted, and these are social norms. Various commodities were used in pre-Revolutionary America including wampum (shell beads), maize (corn), iron nails, beaver pelts, and tobacco.

https://en.wikipedia.org/wiki/Commodity_money

https://en.wikipedia.org/wiki/Troy_weight

https://en.wikipedia.org/wiki/Hudson%27s_Bay_tokens

https://en.wikipedia.org/wiki/Fraud

https://en.wikipedia.org/wiki/United_States_dollar

https://en.wikipedia.org/wiki/Central_bank

https://en.wikipedia.org/wiki/Developed_country

https://en.wikipedia.org/wiki/Monetary_base

https://en.wikipedia.org/wiki/Monetary_authority

https://en.wikipedia.org/wiki/Monopoly

https://en.wikipedia.org/wiki/Digital_card#Magnetic_stripe_card

https://en.wikipedia.org/wiki/Smart_card

https://en.wikipedia.org/wiki/Forrest_Parry

https://en.wikipedia.org/wiki/Universal_integrated_circuit_card

https://en.wikipedia.org/wiki/Mobile_phone

https://en.wikipedia.org/wiki/Landline

https://en.wikipedia.org/wiki/Public_switched_telephone_network

https://en.wikipedia.org/wiki/GSM

https://en.wikipedia.org/wiki/Debit_card

https://en.wikipedia.org/wiki/Stored-value_card

https://en.wikipedia.org/wiki/Payment_card

https://en.wikipedia.org/wiki/Payment_system

https://en.wikipedia.org/wiki/Value_(economics)

https://en.wikipedia.org/wiki/Financial_transaction

https://en.wikipedia.org/wiki/Bank_account

https://en.wikipedia.org/wiki/Bank_statement

https://en.wikipedia.org/wiki/Financial_institution

A building society is a financial institution owned by its members as a mutual organization. Building societies offer banking and related financial services, especially savings and mortgage lending. Building societies exist in the United Kingdom, Australia and New Zealand, and used to exist in Ireland and several Commonwealth countries. They are similar to credit unions in organisation, though few enforce a common bond. However, rather than promoting thrift and offering unsecured and business loans, the purpose of a building society is to provide home mortgages to members. Borrowers and depositors are society members, setting policy and appointing directors on a one-member, one-vote basis. Building societies often provide other retail banking services, such as current accounts, credit cards and personal loans. The term "building society" first arose in the 19th century in Great Britain from cooperative savings groups.

In the United Kingdom, building societies actively compete with banks for most consumer banking services, especially mortgage lending and savings accounts, and regulations permit up to half of their lending to be funded by debt to non-members, allowing societies to access wholesale bond and money markets to fund mortgages. The world's largest building society is Britain's Nationwide Building Society. Further, in Australia, building societies also compete with retail banks and offer the full range of banking services to consumers.

https://en.wikipedia.org/wiki/Building_society

https://en.wikipedia.org/wiki/Statute

https://en.wikipedia.org/wiki/Crime

No comments:

Post a Comment