Government failure, in the context of public economics, is an economic inefficiency caused by a government intervention, if the inefficiency would not exist in a true free market.[1] The costs of the government intervention are greater than the benefits provided. It can be viewed in contrast to a market failure, which is an economic inefficiency that results from the free market itself, and can potentially be corrected through government regulation. However, Government failure often arises from an attempt to solve market failure. The idea of government failure is associated with the policy argument that, even if particular markets may not meet the standard conditions of perfect competition required to ensure social optimality, government intervention may make matters worse rather than better.

As with a market failure, government failure is not a failure to bring a particular or favored solution into existence but is rather a problem that prevents an efficient outcome. The problem to be solved does not need to be market failure; governments may act to create inefficiencies even when an efficient market solution is possible.

Government failure (by definition) does not occur when government action creates winners and losers, making some people better off and others worse off than they would be without governmental regulation. It occurs only when governmental action creates an inefficient outcome, where efficiency would otherwise exist. A defining feature of government failure is where it would be possible for everyone to be better off (Pareto improvement) under a different regulatory environment.

Examples of government failure include regulatory capture and regulatory arbitrage. Government failure may arise because of unanticipated consequences of a government intervention, or because an inefficient outcome is more politically feasible than a Pareto improvement to it. Government failure can be on both the demand side and the supply side. Demand-side failures include preference-revelation problems and the illogic of voting and collective behaviour. Supply-side failures largely result from principal–agent problem.[2] Government failure may arise in any of three ways the government can involve in an area of social and economic activity: provision, taxation or subsidy and regulation.[3]

History

The phrase "government failure" emerged as a term of art in the early 1960s with the rise of intellectual and political criticism of government regulations. Building on the premise that the only legitimate rationale for government regulation was market failure, economists advanced new theories arguing that government interventions in markets were costly and tend to fail.[4]

An early use of "government failure" was by Ronald Coase (1964) in comparing an actual and ideal system of industrial regulation:[5]

- Contemplation of an optimal system may provide techniques of analysis that would otherwise have been missed and, in certain special cases, it may go far to providing a solution. But in general its influence has been pernicious. It has directed economists’ attention away from the main question, which is how alternative arrangements will actually work in practice. It has led economists to derive conclusions for economic policy from a study of an abstract of a market situation. It is no accident that in the literature...we find a category "market failure" but no category "government failure." Until we realize that we are choosing between social arrangements which are all more or less failures, we are not likely to make much headway.

Roland McKean used the term in 1965 to suggest limitations on an invisible-hand notion of government behavior.[6] More formal and general analysis followed[7] in such areas as development economics,[8] ecological economics,[9] political science,[3] political economy,[10] public choice theory,[11] and transaction-cost economics.[12] Later, due to the popularity of public choice theory in 1970s, government failure attracted the attention of the academic community.

https://en.wikipedia.org/wiki/Government_failure

Causes of government failure

Imperfect information

While a perfectly informed government might make an effort to reach the social equilibrium via quality, quantity, price or market structure regulation, it is difficult for the government to obtain necessary information (such as production costs) to make right decisions. This absence may then result in flawed quantity regulation when either too much or too little of the good or service is produced, subsequently creating either excess supply or excess demand. Imperfect information can come in many forms including; Uncertainty, Vagueness, Incompleteness and impreciseness. All creating flaws in government policy's and therefore in turn creating inefficiencies within the economy.[13]

Political Interference

Is not uncommon where government policies are influenced by groups of people with common interests (unions or political parties). The influence of these groups can affect policy's, where they could overlook market failures leading to greater inefficiency or the government could over pursue policy changes due to the influence creating market failures as this is an incorrect allocation of resources.[13]

Political self-interest

Political self-interest is very similar to political interference however instead of being persuaded by others, the politicians are persuaded by self-interests. This could look like inappropriate allocation of funds or time. Public funds could be pushed to influence voters or time could be allocated to pursue personal inequalities instead of actual market failures.[13]

Policy myopia

Another cause of the government failure, as many critics of government intervention claim, is that politicians tend to look for short term fixes with instant and visible results that do not have to last, to difficult economic problems rather than making thorough analysis for solving long-term solutions.[14][15]

Government intervention and evasion

It is believed that when a government tries to levy higher taxes on goods such as alcohol, also called de-merit goods, it can lead to increase attempts of illegal activities as tax avoidance, tax evasion or development of grey markets, people could try to sell goods with no taxes. Also legalizing and taxing some drugs may arise in a quick expansion of the supply of drugs, which can lead to overconsumption, which can mean a decrease in welfare.[3]

Government subsidies may lead to excess demand, which can be solved in two ways. Either the government chooses to meet all the demand, leading to higher consumption than socially efficient or if it knows the socially efficient amount, it can decide who gets how much of this quantity, a goal accomplished either through queuing and waiting-lists or through delegating the decisions to bureaucrats. Both solutions are inefficient, queueing first meets the demand of people at the front of the queue, which might not be the ones who need or want the product or service the most, but rather the luckiest or the ones with the right connections. Delegating the decisions to bureaucrats leads to problems with human factor and personal interests.[3]

High Administrative and Enforcement costs

Market failure can occur when the costs of the project our weigh the benefits. Costs that are included are; Tax collection through government departments, law enforcement and policy creation. All these costs allocations are quite broad however a lot of people are required to run a secure and efficient system. Cost in the system are classified as a credence-costs as the buyer cannot tell the quantity bought even after buying them. This means that Administration and enforcement costs for a project can be over or under assumed and therefore a market failure can therefore be dismissed easily or over analyzed (however benefits can also be credence-benefits).[14]

Regulatory Capture

Regulatory capture is a problem which occurs whilst trying to implement regulations in selected industry. As government regulators usually have to meet with the industry representatives, they tend to form a personal relationship, which may lead them to be more sympathetic towards requirements and needs of given industry, subsequently making the regulations more favourable towards the producers rather than the society.[3]

Examples

Economic crowding out

Crowding out is when the government over corrects the market failure leading to the displacement of the private sector investment. This involves an excess amount of spending in the public sector, excess increase in interest rates or excess increase in taxes all of which will decrease the public sectors borrowing demand from banks. This whole situation forces inefficiencies in the private sector and therefore shrinks, causing a market failure from a government failure.[16]

Regulatory

Regulatory arbitrage is a regulated institution's taking advantage of the difference between its real (or economic) risk and the regulatory position.[17]

Regulatory capture is the co-opting of regulatory agencies by members of or the entire regulated industry. Rent seeking and rational ignorance are two of the mechanisms which allow this to happen.

Regulatory risk is the risk faced by private-sector firms that regulatory changes will hurt their business.[18]

Alexander Hamilton of the World Bank Institute argued in 2013 that rent extraction positively correlates with government size even in stable democracies with high income, robust rule of law mechanisms, transparency, and media freedom.[19]

Many Austrian economists, such as Murray Rothbard, argue that regulation is the source of market failure in the form of monopoly,[20] adding that the term "natural monopoly" is a misnomer.[21] From this perspective, all governmental interference in free markets creates inefficiencies and are therefore less preferable to private market self-correction.

Distortion of markets

Taxation can lead to market distortion. They can artificially change prices thus distorting markets and disturb the way markets allocate scarce resources. Also, taxes can give people incentive to evade them, which is illegal. Minimum price can also result in markets’ distortion (i.e. alcohol, tobacco). Consumer would spend more on harmful goods, therefore less of their income will be spent on beneficial goods. Subsidies can also lead to misuse of scarce resources as they can help inefficient enterprises by protecting them from free market forces.

Price floors and price ceilings can also lead to social inefficiencies or other negative consequences. If price floors, such as minimum wage, are set above the market equilibrium price, they lead to shortage in supply, in case of minimum wage to a higher unemployment. Similarly the price ceilings, if set under the market equilibrium price, lead to shortage in supply. Rent ceiling for example may then lead to shortage in accommodation.[3] Other problems often arise as consequences of these interventions. Black market of labor and higher unemployment among uneducated and poor are possible consequences of minimum wage while deterioration of residential buildings might be caused by rent ceiling and subsequent lack of incentive for landlords to provide the best services possible.

Principal-agent problem

The principal agent problem; In this situation the agent is the government and the principal is the population that elected them. When the government is elected they now do not just represent the group of people that elected them but everyone who voted. So this can lead to some of the population viewing the new policy as a government failure and some seeing it as a success. This will cause market failure because the agent will peruse their own self-interest instead of the interest of the principals that elected them (political self interest).[22]

State monopolies

Most government providers operate as monopolies (e.g. post offices). Their status is sometimes guaranteed by the government, protecting them from potential competition. Furthermore, as opposed to private monopolies, the thread of bankruptcy is eliminated, as these companies are backed by government money. The companies are thus not facing many efficiency pressures which would push them towards cost minimisation - causing a social inefficiency.[3]

There are still some existing efficiency pressures on state monopoly managers. They mostly come from the possibility of their political masters being voted out of office. These pressures are however unlikely to be as effective as market pressures, the reasons being that the elections are held quite infrequently and even their results are often fairly independent on the efficiency of state monopolies.[3]

Corruption

The private utilization of public resources by the government officials. Corruption can take many forms, ranging from direct misappropriation of government funds to the collection of bribes in exchange for public policies.[23]

EU Fisheries Policy

A leading example of governmental failure can be seen with the consequences of the European Union's Common Fisheries Policy (CFP). Set up to counteract a concern of balancing natural marine resources with commercial profiteering, the CFP has in turn created political upheaval.[24]

Overcoming government failure

When a country gets into this kind of complicated situation it is not possible to reverse it right away. However, there are some arrangements that the government could do, to try to overcome it step by step.[25] For example:

- The government could assign itself some future goals, and also try to fulfil them

- Competitive Tendering – making good offers to private and public sector which may arise on into competition between them, which is good for moving forward

- Public & Private Partnerships – involving private professional to make decisions to cut less necessary costs or to help to make some decisions. One of the key steps can also be to delegate the power and decisions, which may release the pressure from the government and help it to concentrate on more important cases

See also

Notes

• Eduardo Wiesner (1998). "Transaction Cost Economics and Public Sector Rent-Seeking in Developing Countries: Toward a Theory of Government Failure," in E. Wiesner and R. Picciotto, ed. Evaluation and Development: The Institutional Dimension, pp. 108–123. World Bank.

• _____ (2003). Markets Or Governments: Choosing between Imperfect Alternatives, MIT Press. Description and chapter-preview links.

• Mrinal Datta-Chaudhuri (1990). "Market Failure and Government Failure." Journal of Economic Perspectives, 4(3), pp. 25–39[dead link].

• Aidan R. Vining and David L. Weimer (1990). "Government Supply and Government Production Failure: A Framework Based on Contestability," Journal of Public Policy Journal of Public Policy, 10(1), pp. 1–22. Abstract.

• Joseph E. Stiglitz (1998). "The Private Uses of Public Interests: Incentives and Institutions," Journal of Economic Perspectives, 12(2), pp. 3–22.

• Richard O. Zerbe Jr. and Howard E. McCurdy (1999). "The Failure of Market Failure," Journal of Policy Analysis and Management, 18(4), pp. 558–578. Abstract. Reprinted in Economic Efficiency in Law and Economics," pp. 164–187.

• Clifford Winston (2006). Government Failure versus Market Failure: Microeconomics Policy Research and Government Performance. Brookings Institution Press. Link. Archived 2011-04-29 at the Wayback Machine

• Eduardo Wiesner (1998). "Transaction Cost Economics and Public Sector Rent-Seeking in Developing Countries: Toward a Theory of Government Failure," in E. Wiesner and R. Picciotto, ed. Evaluation and Development: The Institutional Dimension, pp. 108–123. World Bank.

• Sturzenegger, Federico, and Mariano Tommasi (1998). The Polítical Economy of Reform, MIT Press. Description Archived 2012-10-11 at the Wayback Machine and links to chapter-previews and "failure".

• Sharun W. Mukand (2008). "policy reform, political economy of," The New Palgrave Dictionary of Economics, 2nd Edition. Abstract.

• Buchanan James M. (2008). "public debt," The New Palgrave Dictionary of Economics , 2nd Edition The New Palgrave Dictionary of Economics (2008), 2nd Edition.Abstract.

• Gordon Tullock et al. (2002), Government Failure: A Primer in Public Choice, Cato Institute. Description and scroll-down for preview.

• Joseph E. Stiglitz (2009). "Regulation and Failure," in David Moss and John Cisternino (eds.), New Perspectives on Regulation, ch. 1, pp. 11–23. Cambridge: The Tobin Project.

This paper hopes to contribute towards an explanation of these empirical regularities by developing and testing a new contextually enriched career concerns model of the political economy of public policy-making.

- Pettinger, Tejvan. "Government Failure". Economics Help.

References

- Aidt, Toke S. (2003). "Economic Analysis of Corruption: A Survey," Economic Journal, 113(491), Features, pp. F632–F652.

- Becker, Gary (1958) "Competition and Democracy," Journal of Law and Economics, 1, pp. 105–1109. Archived 2012-03-28 at the Wayback Machine

- _____ (1983). "A Theory of Competition among Pressure Groups for Political Influence," Quarterly Journal of Economics, 98(3), pp. 371–400.

- Dollery, Brian, and Andrew Worthington (1996). "The Evaluation of Public Policy: Normative Economic Theories of Government Failure," Journal of Interdisciplinary Economics, 7(1), pp. 27–39.

- Grier, Robin M. and, Kevin B. Grier "Political cycles in nontraditional settings: theory and evidence from the case of Mexico", JLE vol. XLIII (April 2000), p. 239

- Kolko, Gabriel (1977), The Triumph of Conservatism, The Free Press, ISBN 0-02-916650-0

- Kolko, Gabriel (1977), Railroads and Regulation, 1877–1916, Greenwood Publishing Company, ISBN 0-8371-8885-7

- The New Palgrave Dictionary of Economics (2008), 2nd Edition with Table of Contents/Abstract links:

"laissez-faire, economists and" by Roger E. Backhouse and Steven G. Medema

"rational choice and political science" by Susanne Lohmann. - Niskanen, William (1967), The Peculiar Economics of Bureaucracy, Institute for Defense Analyses, Program Analysis Division (1967), ASIN B0007H5TBG

- _____ (1971), Bureaucracy and Representative Government, Aldine, Atherton, ISBN 0-202-06040-3

https://en.wikipedia.org/wiki/Government_failure

https://en.wikipedia.org/wiki/Conflict_of_interest

In finance, negative amortization (also known as NegAm, deferred interest or graduated payment mortgage) occurs whenever the loan payment for any period is less than the interest charged over that period so that the outstanding balance of the loan increases. As an amortization method the shorted amount (difference between interest and repayment) is then added to the total amount owed to the lender. Such a practice would have to be agreed upon before shorting the payment so as to avoid default on payment. This method is generally used in an introductory period before loan payments exceed interest and the loan becomes self-amortizing. The term is most often used for mortgage loans; corporate loans with negative amortization are called PIK loans.

Amortization refers to the process of paying off a debt (often from a loan or mortgage) through regular payments. A portion of each payment is for interest while the remaining amount is applied towards the principal balance. The percentage of interest versus principal in each payment is determined in an amortization schedule.

https://en.wikipedia.org/wiki/Negative_amortization

https://en.wikipedia.org/w/index.php?limit=20&offset=500&profile=default&search=internal+account&title=Special:Search&ns0=1&searchToken=2lzvzbkj4t1jwaxubsc5c6qrn

https://en.wikipedia.org/wiki/Throughput_accounting

https://en.wikipedia.org/wiki/Amortization_(accounting)

https://en.wikipedia.org/wiki/Certified_check

https://en.wikipedia.org/wiki/Chart_of_accounts

https://en.wikipedia.org/wiki/Reserve_(accounting)

https://en.wikipedia.org/wiki/Internality

https://en.wikipedia.org/wiki/Basis_of_accounting

https://en.wikipedia.org/wiki/Internally_displaced_person

https://en.wikipedia.org/wiki/Total_internal_reflection

https://en.wikipedia.org/wiki/Account_number

https://en.wikipedia.org/wiki/Reconciliation_(accounting)

https://en.wikipedia.org/wiki/Hedge_accounting

https://en.wikipedia.org/wiki/Internal_auditor

https://en.wikipedia.org/wiki/Goodwill_(accounting)

https://en.wikipedia.org/wiki/Liability_(financial_accounting)

https://en.wikipedia.org/wiki/Comptroller#Business_role

https://en.wikipedia.org/wiki/Internal_communications

https://en.wikipedia.org/wiki/Error_account

https://en.wikipedia.org/wiki/Intrapersonal_communication

https://en.wikipedia.org/wiki/Payment_card_number

https://en.wikipedia.org/wiki/National_Income_and_Product_Accounts

https://en.wikipedia.org/wiki/International_Financial_Reporting_Standards

https://en.wikipedia.org/wiki/General_ledger

https://en.wikipedia.org/wiki/Internal_conversion

https://en.wikipedia.org/wiki/Concentration_account

https://en.wikipedia.org/wiki/Tax-free_savings_account

https://en.wikipedia.org/wiki/Email

https://en.wikipedia.org/wiki/Accounting_liquidity

https://en.wikipedia.org/wiki/Accountant

https://en.wikipedia.org/wiki/Bureau_of_Internal_Revenue

https://en.wikipedia.org/wiki/History_of_accounting

https://en.wikipedia.org/wiki/Professional_accounting_body

https://en.wikipedia.org/wiki/Internalism_and_externalism

https://en.wikipedia.org/wiki/Accounting_scandals

https://en.wikipedia.org/wiki/Consolidation_(business)#More_than_50%_ownership%E2%80%94subsidiary

https://en.wikipedia.org/wiki/Financial_Accounting_Standards_Board

https://en.wikipedia.org/wiki/First_law_of_thermodynamics#Internal_energy_for_an_open_system

https://en.wikipedia.org/wiki/Separation_of_duties

https://en.wikipedia.org/wiki/Chemical_potential#Internal,_external,_and_total_chemical_potential

https://en.wikipedia.org/wiki/Shrinkage_(accounting)

https://en.wikipedia.org/wiki/Environmental_accounting

https://en.wikipedia.org/wiki/Carbon_accounting

https://en.wikipedia.org/wiki/Cost#Types_of_accounting_costs

https://en.wikipedia.org/wiki/Rare-earth_element

https://en.wikipedia.org/wiki/Ice_age

https://en.wikipedia.org/wiki/New_Age

https://en.wikipedia.org/wiki/Gilded_Age

https://en.wikipedia.org/wiki/Human_resource_accounting

https://en.wikipedia.org/wiki/Queens_of_the_Stone_Age

https://en.wikipedia.org/wiki/Ages_of_Man

https://en.wikipedia.org/wiki/Legal_drinking_age

https://en.wikipedia.org/wiki/Golden_Age_of_Piracy

The Golden Age of Piracy is a common designation for the period between the 1650s and the 1730s, when maritime piracy was a significant factor in the histories of the North Atlantic and Indian Oceans.

Histories of piracy often subdivide the Golden Age of Piracy into three periods:

- The buccaneering period (approximately 1650 to 1680), characterized by Anglo-French seamen based in Jamaica and Tortuga attacking Spanish colonies, and shipping in the Caribbean and eastern Pacific.

- The Pirate Round (1690s), associated with long-distance voyages from the Americas to rob Muslim and East India Company targets in the Indian Ocean and Red Sea.

- The post-Spanish Succession period (1715 to 1726), when Anglo-American sailors and privateers left unemployed by the end of the War of the Spanish Succession turned en masse to piracy in the Caribbean, the Indian Ocean, the North American eastern seaboard, and the West African coast.

Narrower definitions of the Golden Age sometimes exclude the first or second periods, but most include at least some portion of the third. The modern conception of pirates as depicted in popular culture is derived largely, although not always accurately, from the Golden Age of Piracy.

Factors contributing to piracy during the Golden Age included the rise in quantities of valuable cargoes being shipped to Europe over vast ocean areas, reduced European navies in certain regions, the training and experience that many sailors had gained in European navies (particularly the British Royal Navy), and corrupt and ineffective government in European overseas colonies. Colonial powers at the time constantly fought with pirates and engaged in several notable battles and other related events.

https://en.wikipedia.org/wiki/Golden_Age_of_Piracy

https://en.wikipedia.org/wiki/Unified_ledger_accounting

https://en.wikipedia.org/wiki/Auditor_independence#Law%2C_regulations_and_the_conceptual_framework_of_accounting

https://en.wikipedia.org/wiki/Social_accounting

https://en.wikipedia.org/wiki/Credit_note

https://en.wikipedia.org/wiki/Balance_sheet

https://en.wikipedia.org/wiki/Throttle

https://en.wikipedia.org/wiki/Password

https://en.wikipedia.org/wiki/Historical_cost

https://en.wikipedia.org/wiki/Delinquent

https://en.wikipedia.org/wiki/Order_management_system

https://en.wikipedia.org/wiki/Current_asset

https://en.wikipedia.org/wiki/Earth%27s_internal_heat_budget

https://en.wikipedia.org/wiki/External_auditor#Difference_from_internal_auditor

https://en.wikipedia.org/wiki/Philosophy_of_accounting

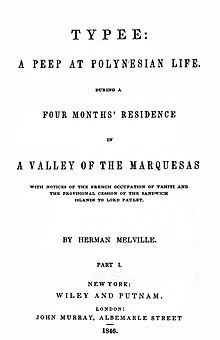

First American edition title page | |

| Author | Herman Melville |

|---|---|

| Country | United States, England |

| Language | English |

| Genre | Travel literature |

| Published |

|

| Media type | |

| Followed by | Omoo |

| Text | Typee at Wikisource |

https://en.wikipedia.org/wiki/Typee

https://en.wikipedia.org/wiki/Computation#The_mapping_account

https://en.wikipedia.org/wiki/Cost_principle

https://en.wikipedia.org/wiki/Credit_card#Revolving_account

https://en.wikipedia.org/wiki/Associate_company

https://en.wikipedia.org/wiki/Internal_conversion_coefficient

https://en.wikipedia.org/wiki/Credit_enhancement#Reserve_account

https://en.wikipedia.org/wiki/Risk_assurance

https://en.wikipedia.org/wiki/Valuation_(finance)

https://en.wikipedia.org/wiki/Special_journals

https://en.wikipedia.org/wiki/Off-balance-sheet

https://en.wikipedia.org/wiki/Cash

https://en.wikipedia.org/wiki/Current_asset

https://en.wikipedia.org/wiki/Annual_comprehensive_financial_report

https://en.wikipedia.org/wiki/Going_concern

https://en.wikipedia.org/wiki/Maximum_brake_torque

https://en.wikipedia.org/wiki/Motivation

https://en.wikipedia.org/wiki/Compression_ratio

https://en.wikipedia.org/wiki/Index_of_accounting_articles

https://en.wikipedia.org/wiki/Accounting_Hall_of_Fame

https://en.wikipedia.org/wiki/Camel_case

https://en.wikipedia.org/wiki/Oral_tradition

https://en.wikipedia.org/wiki/Gear#External_versus_internal_gears

https://en.wikipedia.org/wiki/Earnings_quality

https://en.wikipedia.org/wiki/Insolvency

https://en.wikipedia.org/wiki/Balance_of_payments

https://en.wikipedia.org/wiki/Operating_expense

https://en.wikipedia.org/wiki/Social_media

https://en.wikipedia.org/wiki/Genesis_creation_narrative

https://en.wikipedia.org/wiki/Ocean#Extraterrestrial_oceans

https://en.wikipedia.org/wiki/Water_footprint

https://en.wikipedia.org/wiki/Revaluation_of_fixed_assets

https://en.wikipedia.org/wiki/Adjusting_entries

https://en.wikipedia.org/wiki/Engine_knocking

https://en.wikipedia.org/wiki/Available_for_sale

https://en.wikipedia.org/wiki/Deferred_tax

https://en.wikipedia.org/wiki/Cheka

https://en.wikipedia.org/wiki/Four-stroke_engine

https://en.wikipedia.org/wiki/Geothermal

https://en.wikipedia.org/wiki/Broken_plural

https://en.wikipedia.org/wiki/Accounting_network

https://en.wikipedia.org/wiki/Unit_of_measure_(disambiguation)

https://en.wikipedia.org/wiki/Earnings_before_interest,_taxes,_depreciation_and_amortization

https://en.wikipedia.org/wiki/Land_of_the_Gods

https://en.wikipedia.org/wiki/Engine_knocking

https://en.wikipedia.org/wiki/Fuel_fraction

https://en.wikipedia.org/wiki/Bone_Black

https://en.wikipedia.org/wiki/Budget

https://en.wikipedia.org/wiki/Constant_purchasing_power_accounting

https://en.wikipedia.org/wiki/Generally_Accepted_Accounting_Principles_(Canada)

https://en.wikipedia.org/wiki/Blood_eagle#Accounts

https://en.wikipedia.org/wiki/Single-entry_bookkeeping

https://en.wikipedia.org/wiki/Value_network

https://en.wikipedia.org/wiki/Thermodynamic_equilibrium#Thermodynamic_state_of_internal_equilibrium_of_a_system

https://en.wikipedia.org/wiki/Employer_Identification_Number

https://en.wikipedia.org/wiki/Two_sets_of_books

https://en.wikipedia.org/wiki/Cost%E2%80%93volume%E2%80%93profit_analysis

https://en.wikipedia.org/wiki/Tim_Leissner

https://en.wikipedia.org/wiki/Twenty-sixth_Amendment

https://en.wikipedia.org/wiki/Inductivism

https://en.wikipedia.org/wiki/Comparison_of_401(k)_and_IRA_accounts

https://en.wikipedia.org/wiki/Pillar_of_salt

https://en.wikipedia.org/wiki/Current_liability

https://en.wikipedia.org/wiki/Generally_Accepted_Auditing_Standards

https://en.wikipedia.org/wiki/Correspondent_inference_theory

https://en.wikipedia.org/wiki/Inventory_turnover

https://en.wikipedia.org/wiki/Form_W-9

https://en.wikipedia.org/wiki/Gustilo_open_fracture_classification

https://en.wikipedia.org/wiki/Fiscal_year

https://en.wikipedia.org/wiki/Backflush_accounting

https://en.wikipedia.org/wiki/Temperature

https://en.wikipedia.org/wiki/Bank_Secrecy_Act

https://en.wikipedia.org/wiki/Wirecard

https://en.wikipedia.org/wiki/Internal_devaluation

https://en.wikipedia.org/wiki/Identity_management

https://en.wikipedia.org/wiki/Zastava_M88

https://en.wikipedia.org/wiki/Margin_of_safety

https://en.wikipedia.org/wiki/Orrery#History

https://en.wikipedia.org/wiki/Internal_Revenue_Code_section_132(a)

https://en.wikipedia.org/wiki/Deferral

https://en.wikipedia.org/wiki/Monoidal_category

https://en.wikipedia.org/wiki/Payable-through_account

https://en.wikipedia.org/wiki/Sarbanes%E2%80%93Oxley_Act#Sarbanes%E2%80%93Oxley_Section_404%3A_Assessment_of_internal_control

https://en.wikipedia.org/wiki/List_of_HTTP_status_codes

https://en.wikipedia.org/wiki/Environment_variable#Internal_variable

https://en.wikipedia.org/wiki/Friction

https://en.wikipedia.org/wiki/Morphology_(biology)

https://en.wikipedia.org/wiki/Social_accounting_and_audit

https://en.wikipedia.org/wiki/Verification

https://en.wikipedia.org/wiki/Continuous_auditing

https://en.wikipedia.org/wiki/Punctum

https://en.wikipedia.org/wiki/Ecological_rationality

https://en.wikipedia.org/wiki/Accounting_constraints

https://en.wikipedia.org/wiki/Google_Drive#Individual_user_account_storage

https://en.wikipedia.org/wiki/Haemophilia

https://en.wikipedia.org/wiki/Earnings_surprise

https://en.wikipedia.org/wiki/Outsourcing

https://en.wikipedia.org/wiki/Dematerialization

https://en.wikipedia.org/wiki/Contingent_liability

https://en.wikipedia.org/wiki/Technocracy_(disambiguation)

https://en.wikipedia.org/wiki/Heat_transfer_coefficient

https://en.wikipedia.org/wiki/Use_tax

https://en.wikipedia.org/wiki/Photo_identification

https://en.wikipedia.org/wiki/Self-perception_theory

https://en.wikipedia.org/wiki/Voluntary_disclosure

https://en.wikipedia.org/wiki/FSA_Eligibility_List

https://en.wikipedia.org/wiki/Self-agency

https://en.wikipedia.org/wiki/Write-off#Accounting

https://en.wikipedia.org/wiki/Cheque_fraud

https://en.wikipedia.org/wiki/HSA

https://en.wikipedia.org/wiki/Relevant_cost

https://en.wikipedia.org/wiki/YouTube

https://en.wikipedia.org/wiki/Libya_(Greek_myth)

https://en.wikipedia.org/wiki/Federated_identity

https://en.wikipedia.org/wiki/System_for_Cross-domain_Identity_Management

https://en.wikipedia.org/wiki/Ungoogled-chromium

https://en.wikipedia.org/wiki/Statement_of_changes_in_equity

https://en.wikipedia.org/wiki/Paid-in_capital

https://en.wikipedia.org/wiki/Shockley_diode_equation

https://en.wikipedia.org/wiki/Slaughter_of_the_Innocents

https://en.wikipedia.org/w/index.php?title=Fault,_Configuration,_Accounting,_Performance_and_Security&redirect=no

https://en.wikipedia.org/wiki/Misanthropy#Forms_of_human_flaws

https://en.wikipedia.org/wiki/Litigation_involving_the_Wikimedia_Foundation

https://en.wikipedia.org/wiki/List_of_freedom_indices

https://en.wikipedia.org/wiki/Inferno_(Dante)

https://en.wikipedia.org/wiki/Tu_quoque

https://en.wikipedia.org/wiki/Formal_fallacy

https://en.wikipedia.org/wiki/Validity_(logic)

https://en.wikipedia.org/wiki/Well-formed_formula

https://en.wikipedia.org/wiki/Syntax_(logic)

https://en.wikipedia.org/wiki/Educational_system

https://en.wikipedia.org/wiki/Educational_stage

https://en.wikipedia.org/wiki/International_Standard_Classification_of_Education

https://en.wikipedia.org/wiki/UNESCO

A graduated payment mortgage loan, often referred to as GPM, is a mortgage with low initial monthly payments which gradually increase over a specified time frame. These plans are mostly geared towards young people who cannot afford large payments now, but can realistically expect to raise their incomes in the future. For instance a medical student who is just about to finish medical school might not have the financial capability to pay for a mortgage loan, but once graduated, it is more than probable to be earning a high income. It is a form of negative amortization loan.

https://en.wikipedia.org/wiki/Graduated_payment_mortgage_loan

The Federal Housing Administration (FHA), also known as the Office of Housing within the Department of Housing and Urban Development (HUD), is a United States government agency founded by President Franklin Delano Roosevelt, created in part by the National Housing Act of 1934. The FHA insures mortgages made by private lenders for single-family properties, multifamily rental properties, hospitals, and residential care facilities. FHA mortgage insurance protects lenders against losses. If a property owner defaults on their mortgage, FHA pays a claim to the lender for the unpaid principal balance. Because lenders take on less risk, they are able to offer more mortgages. The goal of the organization is to facilitate access to affordable mortgage credit for low- and moderate-income and first-time homebuyers, for the construction of affordable and market rate rental properties, and for hospitals and residential care facilities in communities across the United States and its territories.

https://en.wikipedia.org/wiki/Federal_Housing_Administration

The United States Department of Housing and Urban Development (HUD) is one of the executive departments of the U.S. federal government. It administers federal housing and urban development laws. It is headed by the Secretary of Housing and Urban Development, who reports directly to the President of the United States and is a member of the president's Cabinet.

Although its beginnings were in the House and Home Financing Agency, it was founded as a Cabinet department in 1965, as part of the "Great Society" program of President Lyndon B. Johnson, to develop and execute policies on housing and metropolises.

https://en.wikipedia.org/wiki/United_States_Department_of_Housing_and_Urban_Development

The architecture of Russia refers to the architecture of modern Russia as well as the architecture of both the original Kievan Rus’ state, the Russian principalities, and Imperial Russia. Due to the geographical size of modern and Imperial Russia, it typically refers to architecture built in European Russia, as well as European influenced architecture in the conquered territories of the Empire.

https://en.wikipedia.org/wiki/Architecture_of_Russia

No comments:

Post a Comment